In this Monday, April 4, 2011, file photo, Federal Reserve Chairman Ben Bernanke addresses a financial markets conference meeting, in Stone Mountain, Ga. Ben Bernanke's term as chairman of the Federal Reserve expires one year from Thursday, Jan 31, 2013, Sometime between now and then he's likely to take his foot off the gas pedal of financial stimulus that is helping to fuel the still-weak U.S. recovery and begin tapping on the brakes. (AP Photo/David Goldman)

In this Monday, April 4, 2011, file photo, Federal Reserve Chairman Ben Bernanke addresses a financial markets conference meeting, in Stone Mountain, Ga. Ben Bernanke's term as chairman of the Federal Reserve expires one year from Thursday, Jan 31, 2013, Sometime between now and then he's likely to take his foot off the gas pedal of financial stimulus that is helping to fuel the still-weak U.S. recovery and begin tapping on the brakes. (AP Photo/David Goldman)

WASHINGTON (AP) ? When the Federal Reserve meets this week, it's likely to affirm a message it intends to help lift the economy: that consumers and businesses will be able to borrow cheaply well into the future ? even after unemployment has dropped sharply.

Last month, the Fed signaled for the first time that it will tie its policies to specific economic barometers. It said that as long as the inflation outlook is mild, it could keep short-term rates near zero until unemployment dips below 6.5 percent from the current 7.8 percent.

That could take until the end of 2015, the Fed predicted last month.

The Fed's guidance was designed to give consumers, companies and investors a clearer sense of when super-low borrowing costs might start to rise. Though some key sectors of the economy are improving, analysts think the Fed still feels more time is needed for low rates to spur borrowing, spending and economic growth.

One reason is that many Americans remain anxious about the budget impasse in Washington.

"The Fed is dealing with a lot of uncertainty right now, with all the decisions still to be made on federal budget policy," said Diane Swonk, chief economist at Mesirow Financial, who expects the Fed to make no changes in its support programs when its two-day policy meeting ends Wednesday.

At its December meeting, the Fed said it would keep spending $85 billion a month on bond purchases to keep long-term borrowing costs down. It will continue its bond purchases until the job market improved "substantially."

When it buys bonds, the Fed increases its investment portfolio and pumps more money into the financial system ? something critics say could eventually ignite inflation or create dangerous bubbles in assets like real estate or stocks.

On Friday, when the government will release its jobs report for January, unemployment is expected to remain 7.8 percent. That still-high rate, 3? years after the Great Recession officially ended, helps explain why the Fed has kept its key short-term rate at a record low near zero since December 2008, just after the financial crisis erupted.

In a speech in Ann Arbor, Mich., this month, Chairman Ben Bernanke said he thought too little progress had been made in reducing unemployment and signaled that the Fed's aggressive support programs should continue.

"There is still quite a ways to go," Bernanke said of the unemployment crisis. "There are too many people whose skills and talents are being wasted."

Still, some private economists think the Fed will decide to suspend its bond purchases in the second half of this year. They note that the minutes of the Fed's December meeting revealed a split: Some of the 12 voting members thought the bond purchases would be needed through 2013. Others felt the purchases should be slowed or stopped altogether before year's end.

On one point, economists agree: Once the Fed does decide to scale back its stimulative policies, it will signal its intent well before it actually does so. Policymakers will want to blunt the shocks that could reverberate through financial markets, which have been heavily influenced by the loose-credit policies the Fed has engineered for more than four years.

Interest rates have sunk to record lows. And stock prices have risen as many investors have shifted money into the stock market in search of better returns.

"Nothing will change at this meeting, but as time goes on, I think the Fed will begin laying the groundwork for changes," said Sung Won Sohn, an economics professor at the Martin Smith School of Business at California State University.

Once the Fed does tighten its interest-rate policy, it will inevitably jolt the markets, however much it tries to ease the impact, predicted David Jones, chief economist at DMJ Economic Advisors.

"The second the Fed gives a hint that they are in any way being less accommodative, we will see interest rates shoot higher and stock prices fall," Jones said.

Associated Pressliquidmetal gsa scandal kelis dick clark dies ibogaine jamie moyer bone cancer

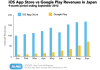

Japan, long called the “Galapagos Islands” of the mobile industry for its cornucopia of sophisticated and unusual feature phones, is finally transitioning to Android and iOS in a serious way. Given the country’s historically high levels of spending on mobile apps and games, it’s becoming a market that Android and iOS developers can’t ignore. For one, it surpassed the U.S. as the most lucrative market for Google Play last fall. App Annie, a mobile app intelligence firm that started out of Beijing, took an in-depth look at the Japanese market. Ironically, Japan has had a relatively slow transition to smartphones if you consider how advanced handsets were throughout the last decade. At the end of 2011, only 23 percent of handsets being used in the country were smartphones. That’s because the carriers like NTT DoCoMo, Softbank and KDDI are extraordinarily powerful. They, like their counterparts in the rest of the world, have historically been the gatekeepers for content. They took a revenue share (although often not as high as Apple’s 30 percent cut) on purchases made through smartphones. That allowed freemium gaming companies like GREE and DeNA to blossom into multi-billion dollar businesses well before we saw similar companies mature in the West. Like in the rest of the world, the iPhone threatens carrier power. NTT DoCoMo doesn’t partner with Apple. It can’t control the flow or sale of content through the iTunes store, which threatens an important revenue stream for the company. They instead focus on Android, and promote their own carrier stores — called ?dmenu,? which is a portal for accessing Internet-based content, and ?dmarket,? which is a market offering videos, music, books, and apps. Meanwhile, KDDI and Softbank have offered the iPhone, and in turn are gaining subscribers at the expense of DoCoMo. Because of these dynamics, two-thirds of Japan’s smartphone population is on Android, while the other third is on the iPhone. Even in spite of this, Apple’s app store easily beats Google Play on revenue. But this gap is narrowing like it is in other markets. The other thing to note is that Japan is an incredibly hard market to break into. The?top five publishers dominate, with nearly one-third of all revenues (and they’re all Japanese).?The success that domestic game developers have had in the feature-phone era has crossed over into smartphone, as well. Japanese companies absolutely dominate the local charts in terms of revenue.

Japan, long called the “Galapagos Islands” of the mobile industry for its cornucopia of sophisticated and unusual feature phones, is finally transitioning to Android and iOS in a serious way. Given the country’s historically high levels of spending on mobile apps and games, it’s becoming a market that Android and iOS developers can’t ignore. For one, it surpassed the U.S. as the most lucrative market for Google Play last fall. App Annie, a mobile app intelligence firm that started out of Beijing, took an in-depth look at the Japanese market. Ironically, Japan has had a relatively slow transition to smartphones if you consider how advanced handsets were throughout the last decade. At the end of 2011, only 23 percent of handsets being used in the country were smartphones. That’s because the carriers like NTT DoCoMo, Softbank and KDDI are extraordinarily powerful. They, like their counterparts in the rest of the world, have historically been the gatekeepers for content. They took a revenue share (although often not as high as Apple’s 30 percent cut) on purchases made through smartphones. That allowed freemium gaming companies like GREE and DeNA to blossom into multi-billion dollar businesses well before we saw similar companies mature in the West. Like in the rest of the world, the iPhone threatens carrier power. NTT DoCoMo doesn’t partner with Apple. It can’t control the flow or sale of content through the iTunes store, which threatens an important revenue stream for the company. They instead focus on Android, and promote their own carrier stores — called ?dmenu,? which is a portal for accessing Internet-based content, and ?dmarket,? which is a market offering videos, music, books, and apps. Meanwhile, KDDI and Softbank have offered the iPhone, and in turn are gaining subscribers at the expense of DoCoMo. Because of these dynamics, two-thirds of Japan’s smartphone population is on Android, while the other third is on the iPhone. Even in spite of this, Apple’s app store easily beats Google Play on revenue. But this gap is narrowing like it is in other markets. The other thing to note is that Japan is an incredibly hard market to break into. The?top five publishers dominate, with nearly one-third of all revenues (and they’re all Japanese).?The success that domestic game developers have had in the feature-phone era has crossed over into smartphone, as well. Japanese companies absolutely dominate the local charts in terms of revenue.

Shipping pallets are a plentiful source of wood to reclaim and build with. Since pallets are rough hewn, they lend themselves to rustic pieces of furniture, which happen to be in style right now. With imagination and some basic carpentry skills, you can turn shipping pallets into all kinds of practical and whimsical furniture. Have a look at nine ideas, all shared by DIY bloggers. A special thanks goes out to Donna of Funky Junk Interiors, a skilled DIY carpenter who built and posted photos of many of these projects.

Shipping pallets are a plentiful source of wood to reclaim and build with. Since pallets are rough hewn, they lend themselves to rustic pieces of furniture, which happen to be in style right now. With imagination and some basic carpentry skills, you can turn shipping pallets into all kinds of practical and whimsical furniture. Have a look at nine ideas, all shared by DIY bloggers. A special thanks goes out to Donna of Funky Junk Interiors, a skilled DIY carpenter who built and posted photos of many of these projects.